Make customer journeys last a lifetime

In the banking and insurance industries, customer trust, satisfaction, and loyalty depend on delivering seamless experiences and resolving issues swiftly. However, translating vast amounts of feedback into effective customer strategies can be a struggle.

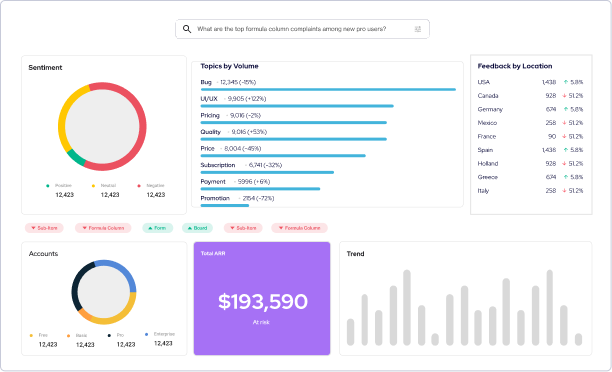

Tagado transforms data from surveys, support tickets, reviews, and other channels into real-time customer sentiment insights, allowing your CX teams to bridge the divide between metrics and action, and to make the kind of high-impact decisions that keep your customers onboard for the long run.

Tagado’s root-cause analysis identifies the underlying factors that affect customer satisfaction metrics such as NPS, CSAT, and CES – allowing for real (rather than symptomatic) issue resolution and smooth customer journeys.

Tagado’s real-time alerts and automated reports will help you to move in front of customer issues and sentiments, proactively fielding feedback across products, regions, and touchpoints – and maintaining a competitive edge.

Tagado custom-trains its advanced AI analytics on your feedback data, capturing the nuances that matter to your industry, products, and clients – and providing the unique insights that drive YOUR business.

With Tagado, there’s no single answer, but rather multiple ones, shifting and dynamic, that respond to each of your clients’ needs in real time. Deliver truly personalized value and see your customer satisfaction and retention grow.

Diversifying is just as effective in feedback as it is in finance. Tagado consolidates feedback data from multiple sources to provide you with the best returns, uncovering business-critical patterns to allow for smarter service, segmentation, and strategy.

You’re in this business to grow, and so is Tagado. Whether you’re handling rising feedback volumes or an expanding customer base, Tagado’s platform scales along with you, adapting its hi-res analytics to your evolving needs.

With NPS Share, Tagado transforms raw Net Promoter Score feedback into a laser-focused prioritization tool. By analyzing and categorizing customer sentiment tied to NPS scores, it quantifies how addressing specific issues can impact your bottom line. Whether it’s a minor tweak with significant financial benefits or a more resource-intensive adjustment, NPS Share helps you weigh the trade-offs, ensuring you focus on initiatives that drive the greatest returns. With this tool, businesses gain a data-driven approach to prioritization and resource allocation, empowering smarter decisions that boost loyalty, retention, and profitability.

Telling the full story behind the metrics